- Home

- PrestaShop

- PrestaShop VIES European VAT Validator VAT Exemption

PrestaShop VIES European VAT Validator VAT Exemption

Effortlessly validate VAT numbers in real-time with VIES integration. Easily exempt VAT for qualifying transactions, improving efficiency in managing European VAT. Streamline your tax management with this all-in-one solution.

PrestaShop VIES European VAT Validator VAT Exemption

Effortlessly validate VAT numbers in real-time with VIES integration. Easily exempt VAT for qualifying transactions, improving efficiency in managing European VAT. Streamline your tax management with this all-in-one solution.

Return policy

Return policy

10-day module exchange guarantee

This module integrates seamlessly with PrestaShop, enabling merchants to validate VAT numbers via VIES and comply effortlessly with European Union VAT regulations.

Offers automated VAT number verification in real-time, ensuring accuracy and eliminating manual errors in tax compliance for EU-based transactions.

Helps merchants reduce tax fraud by verifying VAT numbers against official VIES records before processing orders from European customers.

Allows merchants to issue VAT-exempt invoices for eligible intra-community transactions, meeting EU cross-border trade requirements without manual intervention.

Improves customer confidence by providing visible, reliable VAT number validation during checkout, reassuring buyers of merchant compliance.

Saves time for store owners by automating VAT validation checks instead of performing tedious manual lookups.

Designed for effortless setup with minimal technical knowledge, enabling merchants to quickly activate VAT compliance in their PrestaShop stores.

Reduces legal risks by ensuring all VAT exemptions are backed by official EU VIES verification.

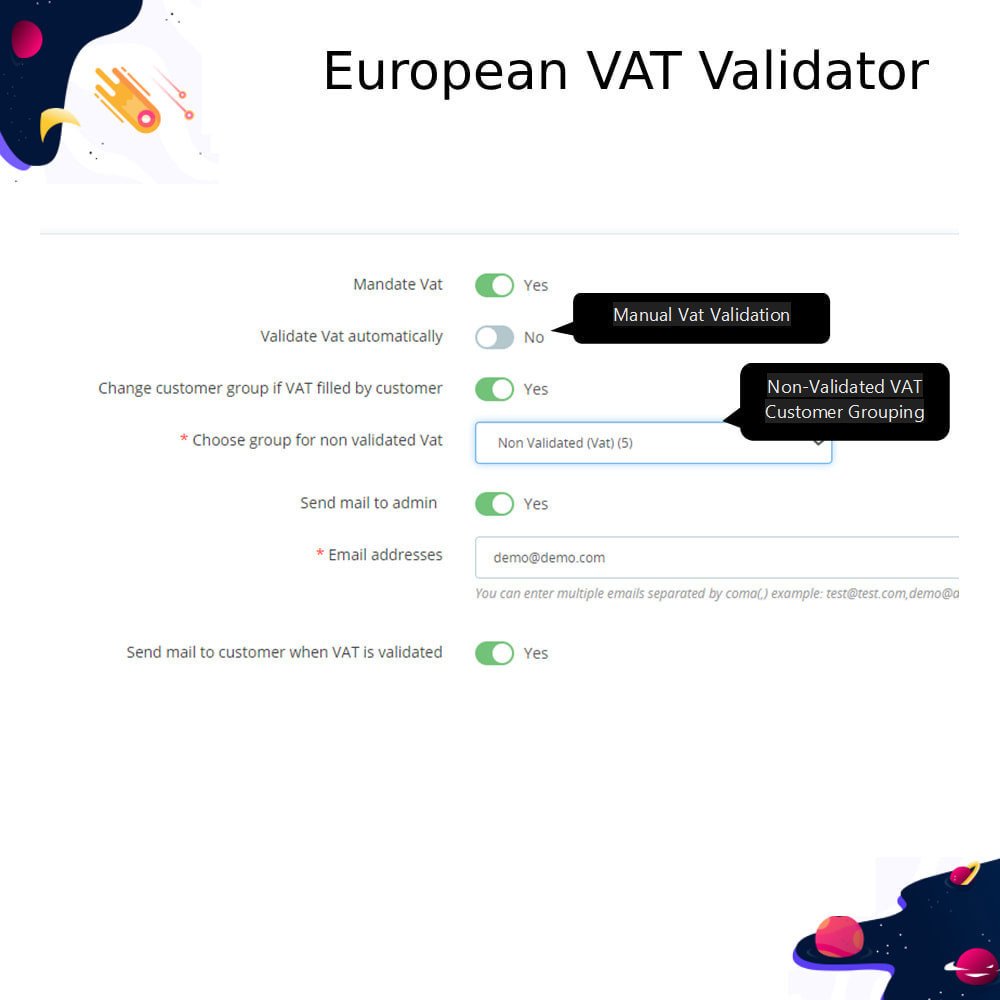

Provides tools for manual VAT checks, allowing merchants to validate numbers outside normal automated processes if necessary.

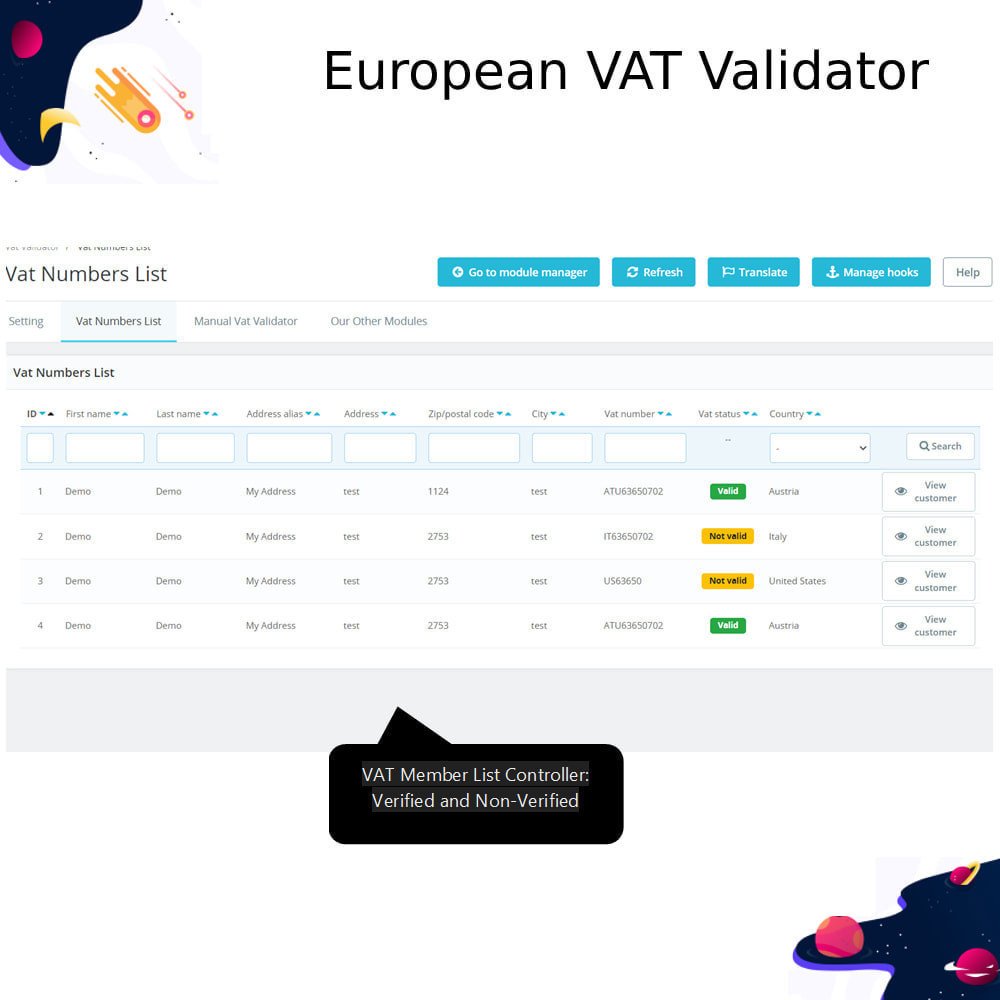

Organizes customers into groups based on VAT validation status for more targeted pricing and offers.

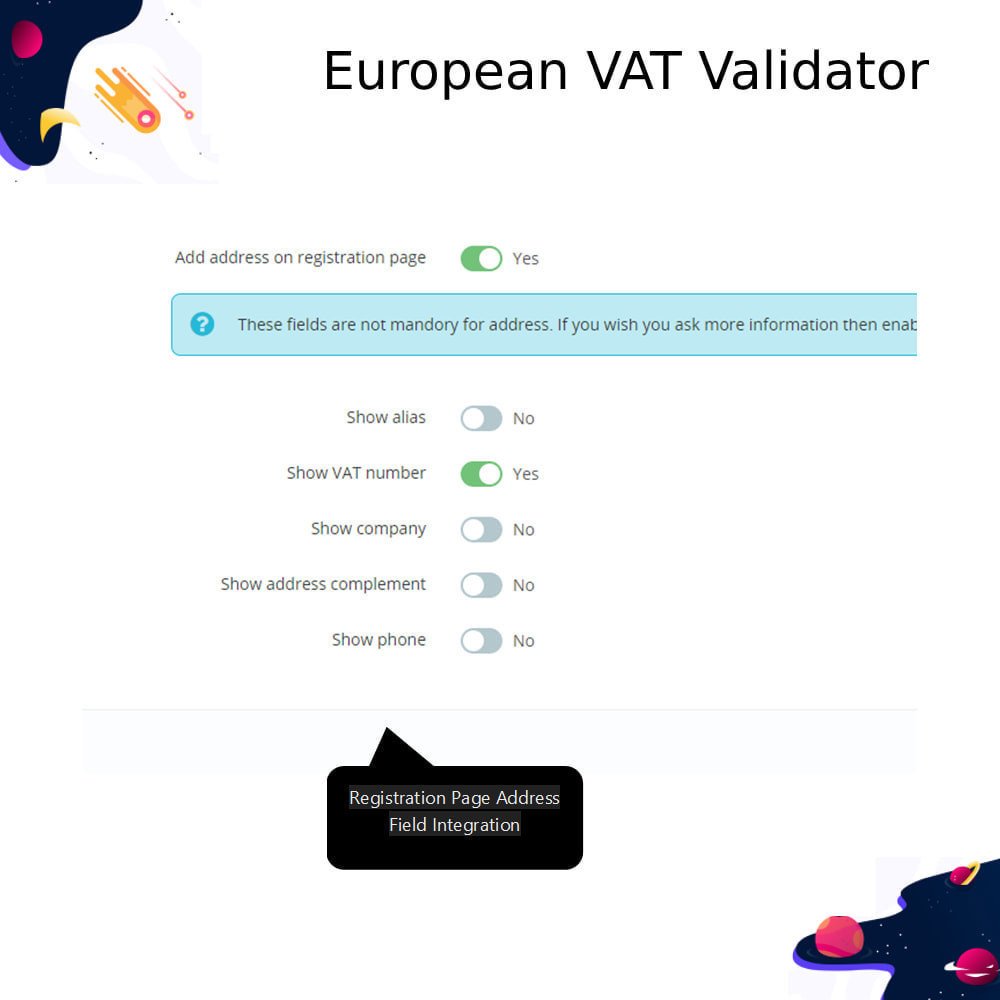

Adds extra address fields during customer registration to capture VAT-related details accurately.

Improves operational efficiency by integrating validation directly into customer onboarding and checkout workflows.

Enables merchants to expand sales to EU markets while maintaining proper tax handling.

Minimizes errors that could lead to financial penalties or disputes in VAT-exempt transactions.

Works silently in the background, ensuring seamless VAT verification without disrupting the customer’s shopping experience.

Automatic VAT number verification using the VIES database for accuracy and reliability.

Real-time validation during checkout to ensure correct tax handling before payment.

Manual validation option for checking VAT numbers via backend interface.

Assigns validated customers to a dedicated group automatically.

Assigns non-validated customers to a separate group for targeted policies.

Supports issuing VAT-exempt invoices for qualifying EU customers.

Adds extra VAT-specific fields to customer registration forms.

Integrates directly with PrestaShop’s order and customer management system.

Configurable settings for VAT handling rules based on business requirements.

Uses official European Commission VIES service for trustworthy validation results.

Displays validation status to both customers and administrators for transparency.

Automatically updates tax calculations based on validation results.

Supports multiple EU member state VAT formats and validation logic.

Requires minimal configuration for initial setup and deployment.

Compatible with latest PrestaShop versions and PHP SOAP extension.

Reduces fraudulent orders by confirming customer VAT information against official EU data.

Saves admin time by removing the need for manual VAT checks.

Improves legal compliance, lowering risk of fines or audits.

Boosts buyer confidence through visible tax compliance during checkout.

Ensures fair and transparent pricing for EU customers.

Simplifies tax exemption processing for eligible business customers.

Enhances customer registration accuracy with additional VAT fields.

Automates tax group assignment, reducing manual administrative work.

Supports cross-border sales by validating intra-community VAT transactions.

Creates smoother checkout experiences with instant VAT verification.

Reduces disputes about VAT application in international transactions.

Increases operational efficiency by integrating VAT checks directly into store processes.

Builds a reputation for professionalism and regulatory adherence.

Helps merchants expand market reach across EU with confidence.

Minimizes tax calculation errors through automated, accurate VAT verification.

Download the module ZIP file from your trusted source.

Log in to your PrestaShop admin dashboard.

Navigate to the Modules section and click “Upload a Module.”

Upload the downloaded ZIP file and wait for installation to complete.

Open the module settings page to configure VAT validation options.

Stop the Apache server from your XAMPP control panel.

Click “Config” next to Apache and select “PHP (php.ini).”

Search for ;extension=soap and remove the semicolon to enable SOAP.

Save php.ini changes, then restart Apache server in XAMPP.

Test the module by validating a sample VAT number through checkout.

What is the PrestaShop VIES European VAT Validator VAT Exemption module?

Does this module work for all EU countries?

Is technical knowledge required for installation?

What is the VIES database?

Can customers validate VAT numbers during checkout?

Does the module support manual VAT validation?

What happens if the VIES service is unavailable?

How does the module handle validated and non-validated customers?

Does this module affect non-EU customers?

Will VAT-exempt invoices be generated automatically?

Customer reviews

Top reviews

David Richardson

David Richardson

Adam Russell

Adam Russell

Operational Benefits of EU VAT Validation & Exemption Module

Fraud Prevention

Time Savings

Legal Compliance

Process Automation

Market Expansion

Error Reduction

Core Features of EU VAT Validation & Exemption Module

Automatic VAT Validation

Validates VAT numbers in real-time via the EU’s VIES system, ensuring accurate tax application and compliance for all eligible intra-community transactions without manual checks.

Manual Verification Option

Allows administrators to validate VAT numbers manually from the PrestaShop back office, providing flexibility when automated validation is unavailable or special verification is required.

Customer Group Assignment

Automatically assigns validated customers to a dedicated VAT-exempt group and non-validated customers to another, enabling tailored tax rules and targeted pricing strategies.

Tax-Free Invoicing

Generates invoices without VAT for validated EU business customers, streamlining the exemption process while ensuring full compliance with European tax regulations.

Enhanced Registration Fields

Adds extra VAT-specific fields to the registration form, capturing necessary details upfront for smoother validation and accurate tax application during checkout.

Multi-Country EU Support

Supports VAT validation for all EU member states participating in the VIES system, making cross-border sales within Europe compliant and efficient.

Power Up Your  rESTASHOP Store — We Handle It All

rESTASHOP Store — We Handle It All

.png)